iowa inheritance tax rate

If the net value of the. In 2020 federal estate tax generally.

Iowa Retirement Tax Friendliness Smartasset

A bigger difference between the two states is how the exemptions to the tax work.

. 12501-25000 has an Iowa inheritance tax rate of 6. Iowas max inheritance tax rate is 15. If your relation to the person leaving you money is any of the above you wont owe inheritance tax regardless of the size of your inheritance.

Which is better than our neighboring state of Nebraska which has the highest top inheritance tax rate of 18. These tax rates are based upon the relationship of the beneficiary to the deceased with no inheritance tax due from spouses and direct lineal descendants or ascendants ie. File a W-2 or 1099.

A summary of the different categories is as follows. The estate tax is a tax on a persons assets after death. The following among others are exempt from Iowas inheritance tax.

In 2013 the Indiana legislature repealed their inheritance tax completely. That is worse than Iowas top inheritance tax rate of 15. Report Fraud.

See the Iowa Inheritance Tax Rate Schedule Form 60-061 090611. These tax rates are based upon the relationship of. Iowa Inheritance Tax Rates.

619 a law which will phase out inheritance taxes at a. In 2021 Iowa decided to repeal its inheritance tax by the year 2025. The tax clearance releases the property from the inheritance tax lien and permits the estate to be closed.

Adopted and Filed Rules. 0-12500 has an Iowa inheritance tax rate of 5. 25001-75500 has an Iowa inheritance tax rate of 7.

For more information on the limitations of the inheritance tax clearance see Iowa. In the meantime there is a phase-out period before the tax completely disappears. What is Iowa inheritance tax.

Unlike federal estate taxes which are paid by the estate Iowas inheritance tax is paid by the beneficiary. Main Page State Taxes Iowa Iowa Inheritance and Estate Taxes Iowa inheritance tax history Inheritance Tax Rates and Exemptions. For decedents dying on or after January 1 202 but before January 1 2022 the 3applicable tax rates listed in Iowa Code.

There are Tax Rate C beneficiaries which applies to uncles aunts nieces nephews foster children cousins brothers-in-law sisters-in-law and all other individuals. On May 19th 2021 the Iowa Legislature similarly passed SF. The Iowa inheritance tax rate varies depending on the relationship of the inheritors to the deceased person.

It has an inheritance tax with a top tax rate of 18. Up to 25 cash back Update. 2022 taxiowagov 60-064 05312022.

Learn About Property Tax. What is the inheritance tax 2020. For instance Iowas inheritance tax does not apply if the estate is valued at 25000 or less.

Learn About Sales. That is worse than Iowas top inheritance tax rate of 15. You Are Here.

Iowa inheritance tax is a tax paid to the State of Iowa and is based upon a persons. Iowa is planning to completely repeal.

2021 State Income Tax Cuts States Respond To Strong Fiscal Health

.png)

Iowa Inheritance Tax Law Explained

Iowa Senate Votes To Eliminate Inheritance Tax Phase In Income Tax Cuts More Quickly

How To Calculate Inheritance Tax 12 Steps With Pictures

Another State Ditches Its Death Tax While Potential Backdoor Federal Estate Tax Looms

Tax Talk If You Die In Iowa Is There A State Estate Tax Gordon Fischer Law Firm

How Much Is Inheritance Tax Community Tax

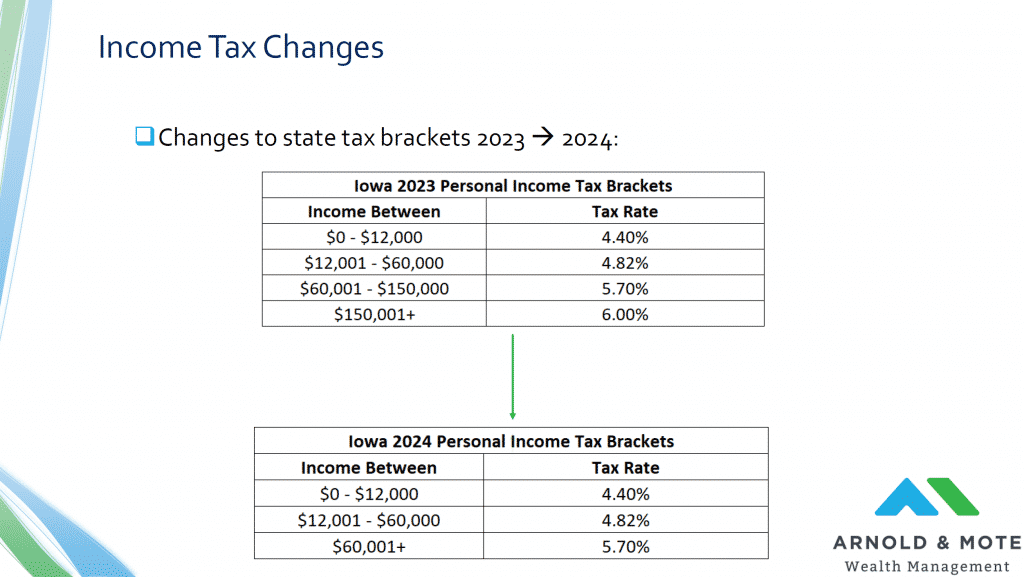

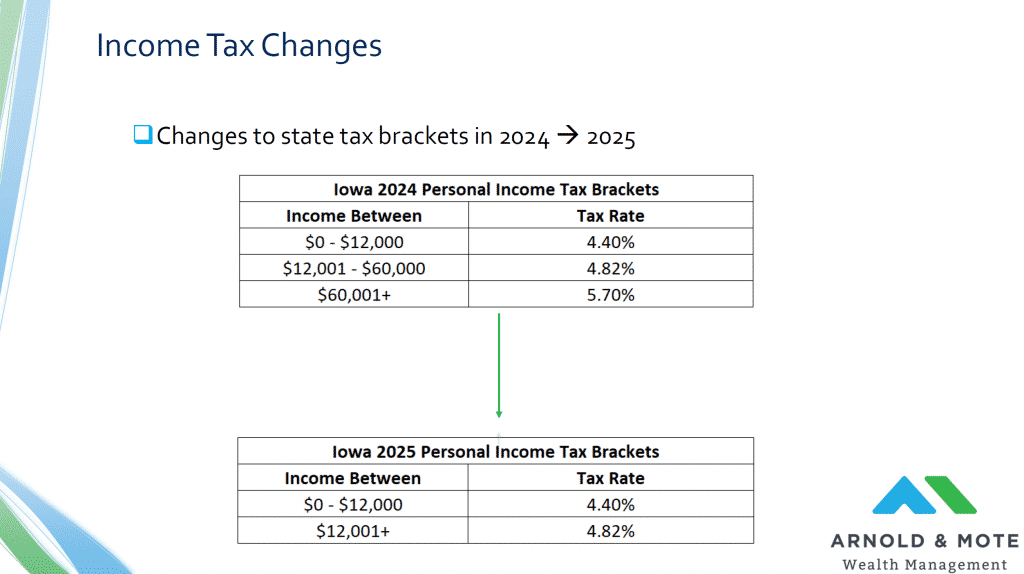

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

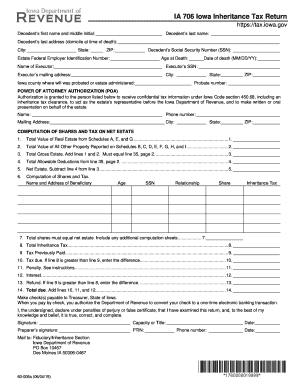

Iowa 706 Form Fill Out And Sign Printable Pdf Template Signnow

Pa 221 Probate Administration Federal Taxes That Could Be Imposed On Someone S Estate Upon Their Death Unit 8 Taxation Ppt Download

State Estate And Inheritance Taxes Itep

Iowa 706 Schedule J Fill Online Printable Fillable Blank Pdffiller

Do I Pay Pa Inheritance Tax If My Relative Lives Out Of State

Iowa Inheritance Laws What You Should Know Smartasset

Iowa Senate Votes To Eliminate Inheritance Tax Phase In Income Tax Cuts More Quickly

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

Inheritance Tax The Executor S Glossary By Atticus

A Guide To The Federal Estate Tax For 2022 And 2023 Smartasset